Consolidate Your Debts

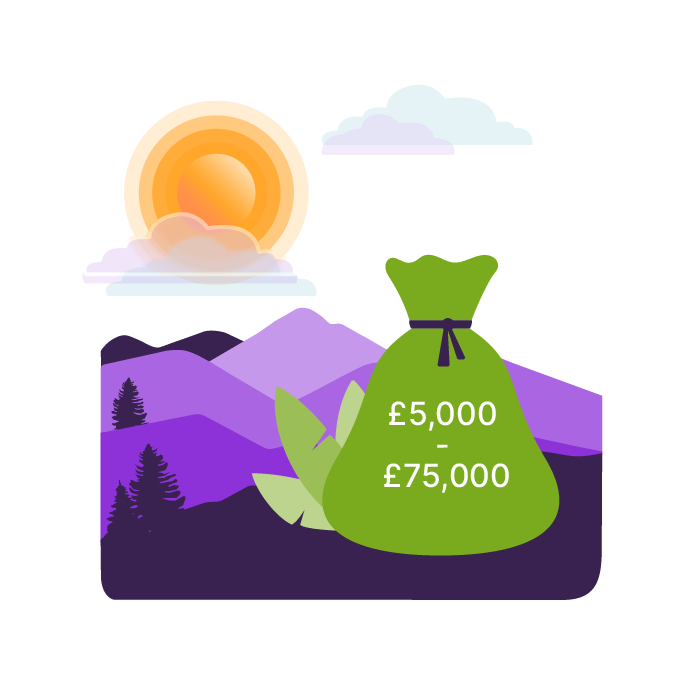

Loans between £5,000 and £75,000

- No upfront fees

- Quick online application

- All credit scores considered

- One affordable monthly payment

Representative Example: Borrowing £7,500 over 60 months, repaying £167.57 per month, total repayable £10,054.20.

Total cost of credit £2,554.20.

Interest rate 12.9% (variable).

The lenders on our panel offer loans for 12-120 months, with rates from 4.4% APR to 49.9% APR.

Consolidate Your Debts in 3 Easy Steps

Start your journey with our quick and easy online application. Start now >

Your application will be reviewed

If approved, the money will be paid straight into your account

What are Debt Consolidation Loans?

A Consolidation Loan aims to simplify life by having everything you owe with one lender. A lump sum of money gets paid directly into your bank account so that you can pay off multiple debts with other lenders. A Consolidation Loan would leave you with a single loan to repay, potentially lower interest and charges, and an extended repayment period of up to 10 years.

One lower monthly payment could make your debt more manageable and affordable.

Consolidation Loans can also be good for your credit if paid back responsibly in the long run, as this shows lenders that you have taken reasonable steps to repay your debt.

Consolidate Now

Do you have Bad Credit?

It could still be worth applying. We work with a panel of lenders that will consider customers in all financial circumstances.

More about debt consolidation loansWhy Choose Us?

One affordable payment

Focus on only one monthly payment.

Bad credit?

No problem. We consider all credit scores - even bad ones!

Expert advice

We are experts in debt solutions.

No upfront fees

No hidden upfront fees to worry about.

Tailored for you

Real rates tailored just for you.

FAQs

Credit Score

Credit Score

Consolidation Express will always help where we can - regardless of your credit history. Some companies may reject you for a personal loan if you have bad credit, but we believe this is unfair. Personal circumstances or a poor credit history shouldn’t stop you from resolving your debts, so we will always consider you.

However, to get the lowest interest rates on consolidation loans, you will usually need a good credit score. As a result, you could still receive the funds you require, but will need to pay higher interest rates compared to someone with a good credit rating.

Yes, you can, but using your credit card afterwards does raise the risk of repeating the problem you began with, so it is a good idea to keep your credit card balance at zero.

Bear in mind too that the longer you keep your credit card at a zero balance while the account is open, the more your credit rating will improve.

Debt consolidation will stay on your credit report for a considerable amount of time, but this is not necessarily a bad thing, assuming your personal loan payments were made in full and on time.

Hard searches will be wiped from your credit history after a year, but most negative information (i.e., if you default on a loan or make late payments) typically stay on credit reports for seven years.

It will be very difficult to consolidate debt without hurting your credit rating, but the negative effects should only be temporary and should quickly improve once you start to pay off creditors on time.

Additionally, a decline in credit score from consolidation loans shouldn't be as bad compared to alternative debt solutions.

What is Debt Consolidation?

What is Debt Consolidation?

It takes just minutes to apply for a consolidation loan with our quick and easy online application. Once completed, our advisors will do all the hard work and be in touch with your options to deal with your loan amount shortly.

If your application is approved, the money will be paid straight into your account!

A debt consolidation loan lets you take out a sum equal to, or greater than, the overall cost of all your existing debts. Once you have received an approved loan, outstanding debts can be paid off one by one.

This leaves you with just one loan to manage, which can be repaid through one affordable single monthly repayment. Consolidation loans are a simple way of dealing with existing debts, and converting them into a single, manageable debt.

There are three main reasons why you have been rejected for a debt consolidation loan:

- Low income - the lender doesn’t think you can afford the repayments to repay your existing loan amount

- Too much existing credit card debt - they don't want to put you into further financial difficulty if your credit card debt is too high

- Low credit score - they think it is too risky to lend to you

Don’t despair and lose hope if you are rejected for a new loan though. There are still many other options available to you, and there could be something that you can do to improve your chances of being approved for a debt consolidation loan.

An unsecured debt consolidation loan is a type of personal loan that can be used to consolidate multiple debts into a single, monthly payment. Unlike a secured loan (which requires collateral), unsecured loans do not require any form of collateral. This makes them a good option for those who do not have any assets to use as collateral.

There are many different types of unsecured debt consolidation loans available, including fixed-rate loans, variable-rate loans, and line of credit products. The best type of debt consolidation loan for you will depend on your individual financial situation, including your existing loans, credit rating and more.

A secured debt consolidation loan is a type of loan that uses collateral to secure the loan. Collateral is an asset that can be used to repay the loan if you default on the payments. The most common type of collateral for a secured consolidation loan is a home equity line of credit (HELOC). Other types of collateral include vehicles, savings accounts, and certificate of deposits (CDs).

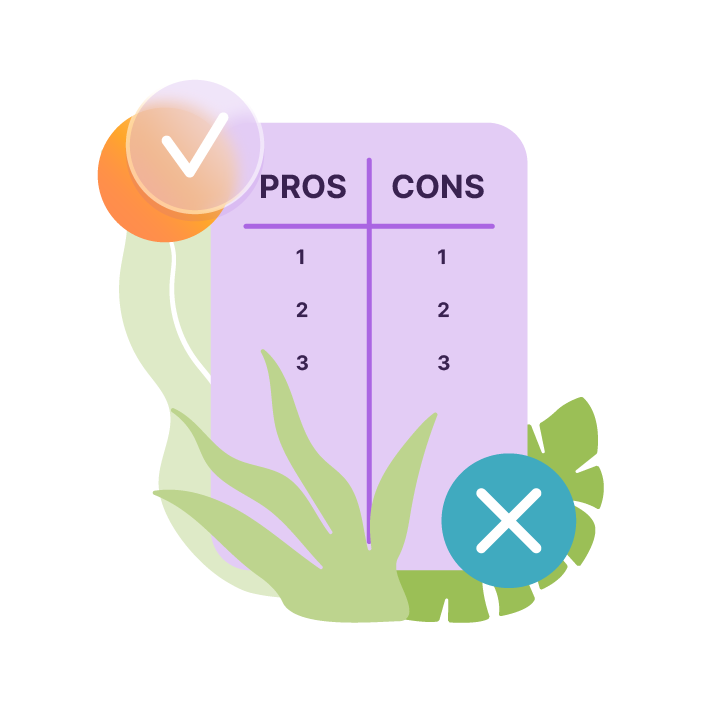

Impact of Debt Consolidation

Impact of Debt Consolidation

A personal loan won’t reduce or write off your debts - you just end up paying a different organisation instead. This means that the same consequences still apply if your repayments aren’t approved, leaving you with the risk of defaulting on the loan.

It can often be useful to compare debt consolidation loans, allowing you to find your exact interest rate, and what the actual debt consolidation loan cost will be in your circumstances.

It depends. Even if you have a debt consolidation loan, you can still buy a car outright with savings, but receiving car finance becomes difficult with debts to your name. Lenders look at a range of factors, though, and consider a range of eligibility criteria, so buying a car is still doable.

There are also steps you can take to improve your chances of success.

Consolidation Express

Consolidation Express

Consolidation Express is a broker, not a lender. We work with a panel of lenders who consider all credit scores, and we usually match our clients with a lender best suited for their unique circumstances. Partnering with our panel, our goal is to provide our clients with the right loan to make debt more manageable.

Consolidation Express is fully regulated by the FCA which means that we can provide clients with free initial advice around debt and finances. Complete an application on our website so we can assess your case and determine if a consolidation loan might be the right solution for you.

Debts you can consolidate

Once a consolidation loan is approved, you can use the money to repay your debts while just paying one affordable monthly payment. Below are some of the most common debts you can consolidate:

Personal Loans

Just barely making the monthly payments? We can help you take control of your finances and make these a thing of the past.

Store Cards

Sometimes, purchases just become essential. If store cards have caused you to have debt, then we can support you in repaying this at an affordable rate.

Credit Cards

Credit card debts can quickly become unmanageable but, don’t worry, we are here to help you.

Payday Loans

If you’re struggling to repay your payday loans, help is available. In just a few hours you could have the funds you need to close these accounts.