Another Debt Crisis? The Cost of Living increase 2022

UK in debt crisis? The Cost of Living is set to increase in 2022 to a record-breaking high. We break down the reasons why and what financial help you can get.

“Everything is getting more expensive.”

You’ve probably heard that your whole life – and that’s because everything is always getting more expensive. So, what’s the problem?

In 2022, the prices are meant to rise more than they’ve risen since 1985 but the wages aren’t meant to increase.

This means your outgoings might start to outweigh your incomings, and if you’re repaying debts, this could become a serious problem.

But don’t panic! We may be able to help.

How much has the cost of living gone up?

There are five main reasons the cost of living is going up:

- Inflation

- Fuel

- Energy

- National Insurance

- Interest rates

What is inflation, and is it good or bad?

Inflation is the general increase, and fall, in prices. If inflation is rising, it means prices are increasing, if it’s falling then prices are falling.

Breaking it down: For example, if a cup of coffee is £1.50 in 2021, and inflation rises by 5% over the year, that same cup of coffee will now cost you £1.57.

Inflation isn’t generally bad because normally wages rise along with it but that isn’t happening.

How much will inflation rise?

The Bank of England stated they “expect inflation to reach over 7% by spring 2022”.

Want to know more about inflation? Check out The Bank of England’s inflation calculator. It’s an interesting way to see how inflation has affected us over time. See what £10 worth of goods in 1950 would be worth today!

Why are fuel prices going up?

Last year we saw fuel prices skyrocket; queues outside petrol stations as places ran out and people went without petrol or diesel.

The main reason fuel is increasing is because of the rising global cost of oil – fuel, and petrol is increasing in price all around the world.

This has only been worsened by the Russian invasion of Ukraine.

Although the UK only imports 6% of its crude oil from Russia, we will still be impacted as other countries import a much larger amount and therefore, will have to raise their prices when they sell to us.

Fuel prices rising also means transport costs will rise.

How much will my energy bill go up?

Energy bills are going up by as much as 50%. What are the numbers?

- Those on a direct debit – £693 increase per year

- Prepayment customers – £708 increase per year

This is a huge hike in prices and could see your bills going up by £59 every month, just for gas and electricity.

The energy price cap increase will come into effect on 1st April 2022 and will affect around 22 million Brits.

Worried about your bills? Check out our blog post about how to save energy and save money!

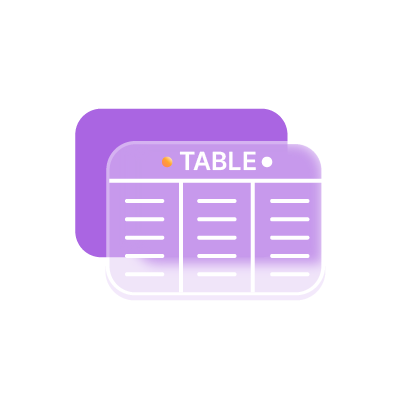

Why has my national insurance increased?

National Insurance is a compulsory payment that anyone who is employed and earning over £184 per week must pay. It is deducted from your wage before you even receive it.

From April 2022, the National Insurance rate is going up by 1.25%. But what does that mean?

We’ve taken some of the standard pay brackets for the UK and put together a table to show how much more you might be paying for National Insurance.

Annual wage

Current N.I. per year

New N.I. per year

£10,000

£51.84

£51.90

£18,000

£1,011

£1,075

£21,000

£1,371

£1,473

£25,000

£1,851

£2,003

£30,000

£2,451

£2,665

£38,000

£3,411

£3,725

£45,000

£4,251

£4,653

Are interest rates going up?

Interest rates will go up from 0.5% to 0.75% – that means credit cards, personal loans and mortgages may be harder to pay back.

In layman’s terms? The rate increase could see Mortgage prices going up by around £26 per month based on a typical customer’s repayment plan.

If you’re dealing with debts including a mortgage, it’s a great time to work out a realistic budget. But if your outgoings are outweighing your incomings, a budget might not always be enough to get you through, especially if you’re repaying more than one debt each month.

If you’re looking for a way to consolidate those debts into one affordable monthly payment, we may be able to help. Turn several payments into one with a debt consolidation loan!

You can consolidate:

- Personal loans

- Store cards

- Credit cards

- and more

How my cost of living will go up

The cost of living increase can be stressful for anyone but for people who are struggling with debts, it can be even more challenging.

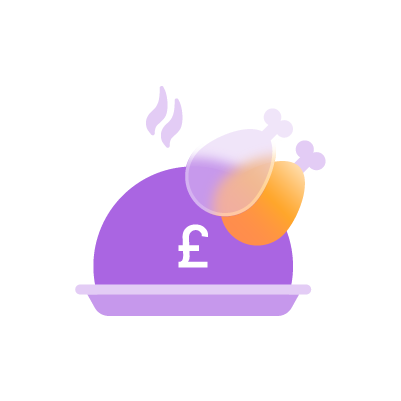

We wanted to see what our customers spend most of their money on, and how we might be able to help as everything gets more expensive.

49.6% of the 131 people we surveyed said that Groceries and Household maintenance was their biggest expense, and 22% said Family and Children were.

We’ve worked out how a 7% inflation will affect the cost of the traditional Sunday roast:

Item

Current price

New price

£4.05

£4.33

£3.00

£3.21

£1.00

£1.07

£1.00

£1.07

£1.25

£1.33

£1.65

£1.76

£1.50

£1.60

*items were taken from Tesco Online Shopping, 17/03/2022.

Overall, a Sunday roast will go from:

- £2.61 for meat roast

- £2.35 for veggie roast

to:

- £2.79 for meat roast

- £2.51 for a veggie roast

*Figures are per person, for a family of four.

This might seem like a small number, but it adds up quickly. Think, even if you’re only spending around an extra 20p per person, every week, that totals £41.60 every year. And that’s just on the Sunday roast, not to mention all the other groceries and other expenses!

How to cut my cost of living

It’s not all doom and gloom! The government is offering some help for UK citizens, such as:

- Council tax rebate – In April 2022, the government will offer a £150 discount on council tax for those in bands A to D. This is a one-off discount and will affect around 80% of people.

- Warm House Discount Scheme – This is a one-off £140 discount for electricity in winter (between October and March). The scheme has been expanded to cover three million UK households.

Even with this help, it’s still going to be a struggle for many of us – and it might be the time to think about cutting back!

How to cut your cost of living when you have debts

Debts may start to mount as you’re struggling to pay for other bills such as energy and groceries. Whether it’s your mortgage or another type of loan, how much you’re paying back will increase. Add on to this the National Insurance increase and all your other expenses going up, and many of us won’t be able to meet our usual repayments.

If you have several creditors for unsecured loans and you’re living in the UK, a Debt Consolidation Loan could be a good option to cut your cost of living.

A Consolidation Loan works by allowing you to borrow enough money to pay off your existing debts, and then you make one affordable monthly payment to your Consolidation Loan lender.

If you’re suffering from the cost of living crisis, and find yourself unable to meet loan repayments, speak to one of our expert advisers. Or fill in our online application to see how you could consolidate your debts. We consider everyone no matter their circumstance or credit rating, so even if you have a bad credit score, we may still be able to help.

See if We Could Help

By: Lily Ruaah

Representative Example: Borrowing £7,500 over 60 months, repaying £167.57 per month, total repayable £10,054.20.

Total cost of credit £2,554.20.

Interest rate 12.9% (variable).

The lenders on our panel offer loans for 12-120 months, with rates from 4.4% APR to 49.9% APR.