How Will a Debt Consolidation Loan Impact My Credit Score?

A debt consolidation loan can impact your credit score in a variety of different ways. Here's how you can make sure your rating changes for the better.

If there’s one question we hear on a regular basis, it’s people asking us how a debt consolidation loan will impact their credit score. It’s a valid query. After all, this solution is primarily aimed at resolving accounts with multiple creditors.

Consequently, it’s likely these debts have accumulated and are adversely affecting credit scores. Taking out an additional loan might not seem like a great idea. Understandably, you probably want to avoid further declines into bad credit.

The good news is that debt consolidation can eventually benefit credit scores – giving you access to better financial products and rates of interest in the future.

How can a loan help my credit score?

There are several ways to improve your credit score, but one of the main methods is to make regular payments to your creditors. Secondly, you should aim to keep your credit utilisation (CU) low. For those who do not know what this is, it’s a percentage of how much credit you’ve used. For example, if your credit limit is £1,000 and you’ve borrowed £500, your CU would be 50%.

A debt consolidation loan typically helps in these two areas through:

- Paying off your existing creditors;

- Making affordable payments, gradually reducing your credit utilisation ratio.

However, it’s worth noting that – to begin with – a debt consolidation loan will probably initially damage your credit score. This is because you’re requesting money through a new account.

Will debt consolidation hurt my credit rating?

Ultimately, a debt consolidation loan can have a positive impact on your credit score. In fact, it’s sometimes used by customers to achieve this very thing. However, this is assuming you make the repayments.

If you’re late in making payments on the loan – or don’t make them at all – this will have a detrimental effect on your credit score.

Furthermore, we advise not taking out additional loans while debt consolidation is active. This is partly due to the increase in credit utilisation which will, again, have an adverse effect on your credit score.

Here’s the bullet point

In the short-term, a debt consolidation loan may adversely affect your credit score due to making a new application. In the longer to medium-term though, this solution will likely have a positive impact on your rating. This is, of course, assuming that you keep up with repayments and use the funds to close down accounts with your current creditors.

Can I apply for a debt consolidation loan?

If you want to find out whether you qualify for debt consolidation, then complete our application form below and we can determine if you’re likely to be successful. If all goes well, you could receive your loan in a couple of hours – and repay your creditors by this time tomorrow.

Apply Now

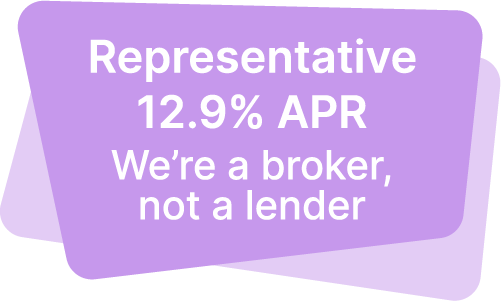

Representative Example: Borrowing £7,500 over 60 months, repaying £167.57 per month, total repayable £10,054.20.

Total cost of credit £2,554.20.

Interest rate 12.9% (variable).

The lenders on our panel offer loans for 12-120 months, with rates from 4.4% APR to 49.9% APR.