What is a Debt Consolidation Loan?

Debt consolidation loans

A debt consolidation loan could be an ideal solution if you want to turn debts with multiple creditors into one simple payment. By borrowing enough money to pay off the debts you owe now, you will only have to repay one lender. This could make your life a lot simpler. Find out more about your debt consolidation loan here.

Get My Loan

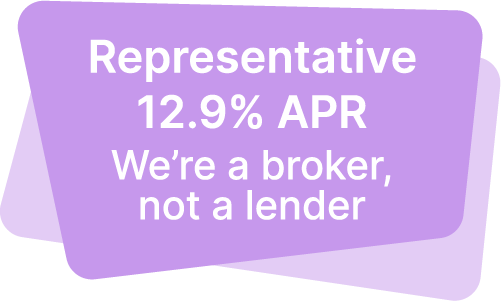

Representative Example: Borrowing £7,500 over 60 months, repaying £167.57 per month, total repayable £10,054.20.

Total cost of credit £2,554.20.

Interest rate 12.9% (variable).

The lenders on our panel offer loans for 12-120 months, with rates from 4.4% APR to 49.9% APR.

Why Choose Us?

One affordable payment

Focus on only one monthly payment.

Bad credit?

No problem. We consider all credit scores - even bad ones!

Expert advice

We are experts in debt solutions.

No upfront fees

No hidden upfront fees to worry about.

Tailored for you

Real rates tailored just for you.

Our Experts Consolidation Loan Definition

"A debt consolidation loan as a type of loan that allows you to combine multiple debts into one single loan, often with a lower interest rate and lower monthly payments.

Essentially, instead of paying off several different loans or credit cards each month, a debt consolidation loan enables you to pay off all of your debts with one loan. This can help simplify your finances and make it easier to manage your debt.

It's worth noting that while a debt consolidation loan can make it easier to manage your debt, it's important to make sure you can afford the repayments on the loan, as failing to keep up with payments could have serious consequences for your credit score and financial situation."

— Andrew Hagger, Financial Consultant at Consolidation Express.

What does a debt consolidation loan do?

By taking out a debt consolidation loan which covers all your outstanding debts, you’ll hopefully only have to pay back one creditor at the end of every month. This brings everything you owe into one place and can help to alleviate the stress from having multiple lenders chasing you. As well as this, the loan could help reduce the amount you pay each month.

However, before making your application it’s important you have a good understanding of the different consolidation loan types and the circumstances when it is the best solution. Debt consolidation loans have two forms, secured and unsecured:

![]() Secured

Secured

This is when a loan is fixed against an asset, usually your home. By securing your property on the loan you are more likely to be accepted. However, if you fall behind on payments you could risk losing your home.

![]() Unsecured

Unsecured

An unsecured loan is when you don’t have to offer your home, or any other asset, as security. However, you may also have to pay more interest on this loan than you would if it was secured.

What debts can be consolidated?

Debt consolidation loans cover a wide variety of expenses. For example:

- Personal loans

- Store cards

- Credit cards

- Short term loans

- Utility arrears

- Phone arrears

Please note this list is not exhaustive. If you’re concerned about a type of debt which isn’t here, you should contact us. Chances are, we might be able to do something about it.

Consolidate NowIs a consolidation loan right for me?

To understand whether a consolidation loan is right for you, you should fit the following criteria:

- You’re struggling to make ends meet due to debts from multiple creditors.

- You have a steady and stable source of income which provides enough to make the repayments.

- The loan would work out as better value than your current situation.

For more information, take a look at our guide: ‘When is debt consolidation worth it?’

If you still think a consolidation loan could be right for you, then our trusted partners can provide amounts up to £75,000 and will consider all credit scores. Our application form is simple and you won’t pay any upfront fees.When a consolidation loan isn’t right

Whether or not a debt consolidation loan is the right decision depends entirely on your situation. If the following applies to you then this solution may not be the best choice:

- You can’t afford any sort of monthly loan repayment.

- You don’t clear all your debts with the loan.

- You end up paying more overall because the monthly repayments are higher or the term of the agreement is longer.

Debt consolidation loans for people with bad credit

If you have bad credit some companies may reject your debt consolidation loan application. We work with a panel of lenders that will consider customer in a range of circumstances.

However, to get the best interest rates on your loan, you will generally need a good credit score. As a result you may have to pay higher interest rates than other customers.

Considerations of debt consolidation

Although debt consolidation has several advantages, it does have some negatives. For example:

- Debts are not written off and must be repaid in full.

- There are interest rates associated with the loan – these charges are not frozen.

- If you don’t keep up with the loan repayments, although you should have time to rectify this, this could result in legal action.

- Depending on the terms you’ve selected, it may take longer to repay your debts than would have otherwise been the case. However, you should be in a better financial state.

How do I apply?

If you decide this is the right option for you, then applying for the loan itself is easy.

Fill out our short online application

You will need to tell us how much you want to borrow and complete the section on personal details. All in all, this shouldn’t take you more than five minutes. Once you’ve completed it, our advisors will do the hard work and be in touch with your options shortly.

Settle existing debts with the loan

If approved for the loan, you’ll need to distribute the money between your existing creditors – closing accounts with them. You should then be left with just one creditor who you will pay back monthly.

Keep up with the monthly repayments

Don’t worry, the repayment terms should be far better than what you’re currently on! Once you’ve repaid your consolidation loan, you should have cleared your debts and you’ll be ready to start a new chapter in your life.

FAQs

At Consolidation Express, we want to help where we can and – regardless of your credit history – we promise your application will get treated with the respect it deserves. After running our standard checks on affordability, if we believe that a loan is the best solution for you then we will try our best to get this granted. Only one way to find out though, apply and we’ll get the ball rolling!

Taking out debt consolidation loans for bad credit can be a good way to improve your credit report. There are plenty of loan places for bad credit available to support people in improving their rating to increase their chances of getting credit in the future. However, your rating will usually initially worsen as you’re taking out a new line of credit. Eventually though, your credit score should improve as you make regular payments on time. Furthermore, as your credit utilisation ratio decreases and the number of creditors shrinks, you should also start to see improvements in your credit rating.

It is important to monitor your credit score when searching for the cheapest debt consolidation loan that’s available to you. This is because your credit score affects the interest you will pay. In some cases, you may be offered a high interest rate on your debt consolidation loan which will increase your overall repayment total.

There are many other solutions to a debt consolidation loan so don’t worry if you’re undecided. When you apply, an advisor will take a look at your circumstances and might suggest an alternative. One which might be better suited to your needs.

Government debt consolidation loans do not exist. Debt management companies have been adopting phrases such as ‘government debt consolidation’ or ‘government debt advice’ which implies that the government approve of this kind of loan. However, this is never the case and the Financial Conduct Authority are working hard to clamp down on this kind of behaviour.